What's Happening with Chinese Housing Crisis?

The Chinese Version of House Of Cards

A famous quote from 2008 financial crisis went something like this, "When the US sneezes, everyone catches cold". On the similar lines, China has become the 'world's factory', so when China feels the heat, the world gets a heatstroke. This phenomenon was recently felt around 2020 and has affected all of us for the past 3 years.

As you would have guessed by now, this series of articles are based on the eastern superpower China. We have split the entire buffet into 3 parts, where we try to breakdown the different market cycle witnessed in India and global markets due to the Chinese economic instability. In this piece we will cover the great housing-crisis in China, which resulted in a 2008 like economic meltdown. In the 2nd half we will cover the inflationary cycle in India and International markets to understand how Chinese meltdown affected consumers like us globally. And lastly, we will cover the current situation, where a price-war has erupted in the global markets. An internally wounded China is flexing its muscles by flooding the markets with cheap goods and commodities. With this series we hope the readers will get an understanding of how the broader markets have behaved in the background, while we were sipping on our tea and complaining about high inflation.

The tale of the current crisis in China starts with our old friend real-estate. The story actually starts when some people from rural China wanted to increase their income and decided to migrate to cities. By some people we mean roughly 290 million migrants between 1978 to 2019. This made real estate companies feel like they are in a gold rush, as the demand for residential real estate was soaring.

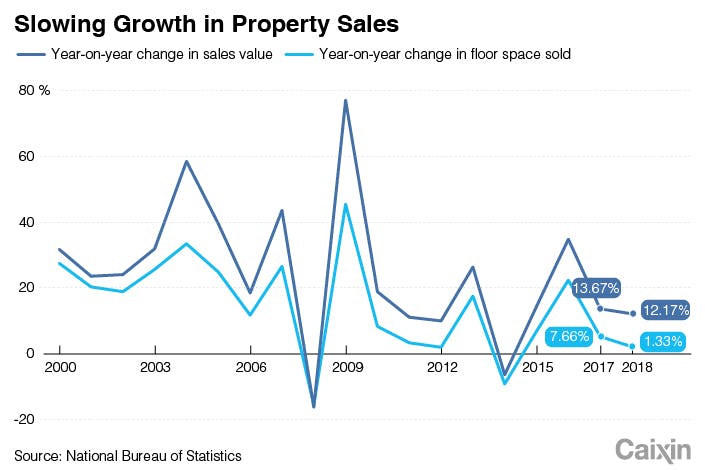

Throughout 2000s, China witnessed huge increase in property rates, as the volume of units sold was increasing quite rapidly. Real-estate also seemed like a more attractive investment option, compared to equities, bonds and bank FDs. This was evident by the fact that in early 2000s, people kept roughly 80% of their entire wealth in real-estate.

Government also promoted real-estate investment because of the high multiplier effect. Many industries benefitted directly from this exponential rise, such as cement, steel, consumer durables, electrical and water works etc. This also led to increase in employment and had a huge impact on the GDP of China. Pre-covid, real estate contributed on an average 30% to China's GDP. For comparison, in India the real-estate contribution is only 7.3% and in US it's 16%.

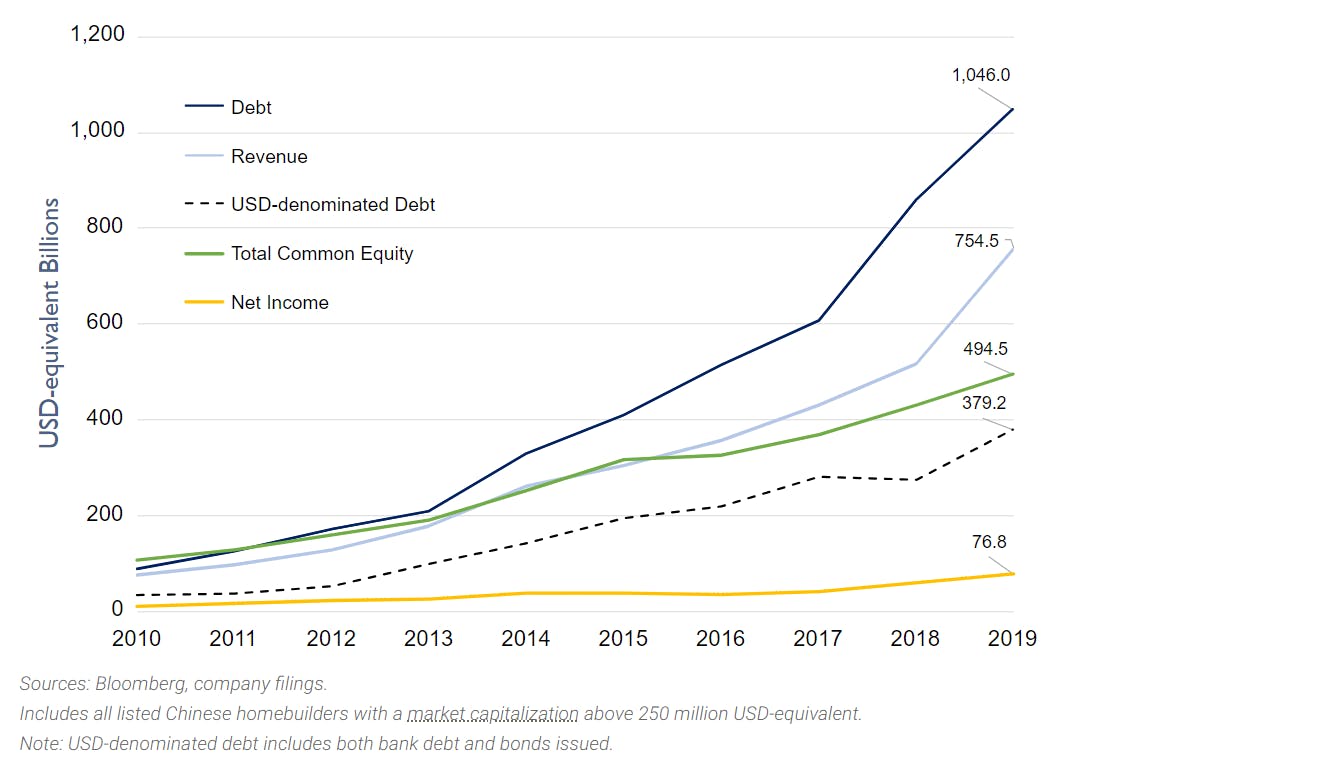

But to finance such rapid expansion, with 1000s of project being launched every year, real estate companies had to resort to heavy borrowing. Companies such as Evergrande were piling up inventory, by overestimating the residential demand. These companies were able to do it either by refinancing debt or over-leveraging their books by using their under-construction projects as securities against borrowing. Even if various projects were completely unsold, real-estate companies would start new projects and would raise new capital. This can also be seen in the numbers - Currently, a total of 7.2 million units are unsold in China and according to some government officials, even the population of 1.4 billion will not be able to completely fill the vacant homes.

The debt raising activities by Chinese real estate companies also saw huge growth throughout 2000s and 2010s. Unsold inventory coupled with large debt on books, resulted in cash-flows issues, thus many under-construction projects were left incomplete. If we look at the number, we can see how over-leveraged the books of real-estate companies were throughout the cycle.

This problem was noticed by the Chinese government, who came a bit too late to the scene. To control real-estate companies' books, Chinese government launched 3-red-line policy. Essentially, the policy sets a certain limit for debt-to-equity, debt-to-cash and debt-to-asset ratio, and all the real-estate companies have to stay within this limit. And lo and behold, the top 30 real estate companies in China breached atleast 2 of these 3 limits. This forced them to decrease their debt, but also prevented them to refinance their older debts which are soon to mature.

No refinancing, coupled with large debt, unsold projects and overestimated demand, the house of cards crumbled in 2020, when one of the biggest real estate companies in China - Evergrande, defaulted on a bond repayment. The company, even though was stuck in a debt trap, was considered "too big to fail", and we all know how that title plays outs. This started one of the biggest housing crisis in China. A term which became famous during the crisis was "Ghost town", where acres of developed properties were unsold and left abandoned by builders.

There was a domino effect of this housing crisis. Nearly 40% of all the loans given out by Chinese banks were property related, including loans given to builders and property owners. Companies started defaulting on their payments as there was no cashflow from sale of property, and homeowners started defaulting as their properties was un-finished and under construction. Developers also defaulted on supplier payments, wages and land rights fee to government. Thus, a systemic crisis erupted where -

Millions of people lost their jobs and many businesses shut shops.

One of the biggest sources of revenue for government - Land rights revenue, saw a decline, thus less public spending.

A sector which contributed the largest to GDP was left handicapped, which would affect both demand and supply in the economy.

This housing crisis, which was one of the biggest financial meltdowns in Chinese history, was during the peak of Covid-19 pandemic, and Chinese government had announced a lockdown. What came next was one the most volatile period of market cycle for commodities, OEMs, equipment manufacturers and food products. This is it for this article, but stay tuned for to understand, how China shutting its shop affected the global economy.

Ladderup Wealth since 2011 has broken the ranks and established itself as one of the most premier wealth management firms in the country. Your wealth is irreplaceable and you have acquired it after decades of hard work. It is important that it is constantly monitored and nurtured with the right approach. You might not have the right time/skills to do it yourselves, but we can help you on that journey. Improper and incompetent advice can have long term side effects on your wealth, so please choose wisely. Get in touch with us via our website today.