Earlier, we stopped our story halfway while narrating the great housing crisis in China. The crisis coincided with the Covid pandemic, and Chinese government had to announce lockdowns. This wouldn't be a very rough situation, as the chaos is a domestic one. But given the importance of China in global trade and manufacturing, the domino effect of the Covid heatstroke on China, spread to other nations as well. And Indian companies and consumers were one of those who came in line-of-fire.

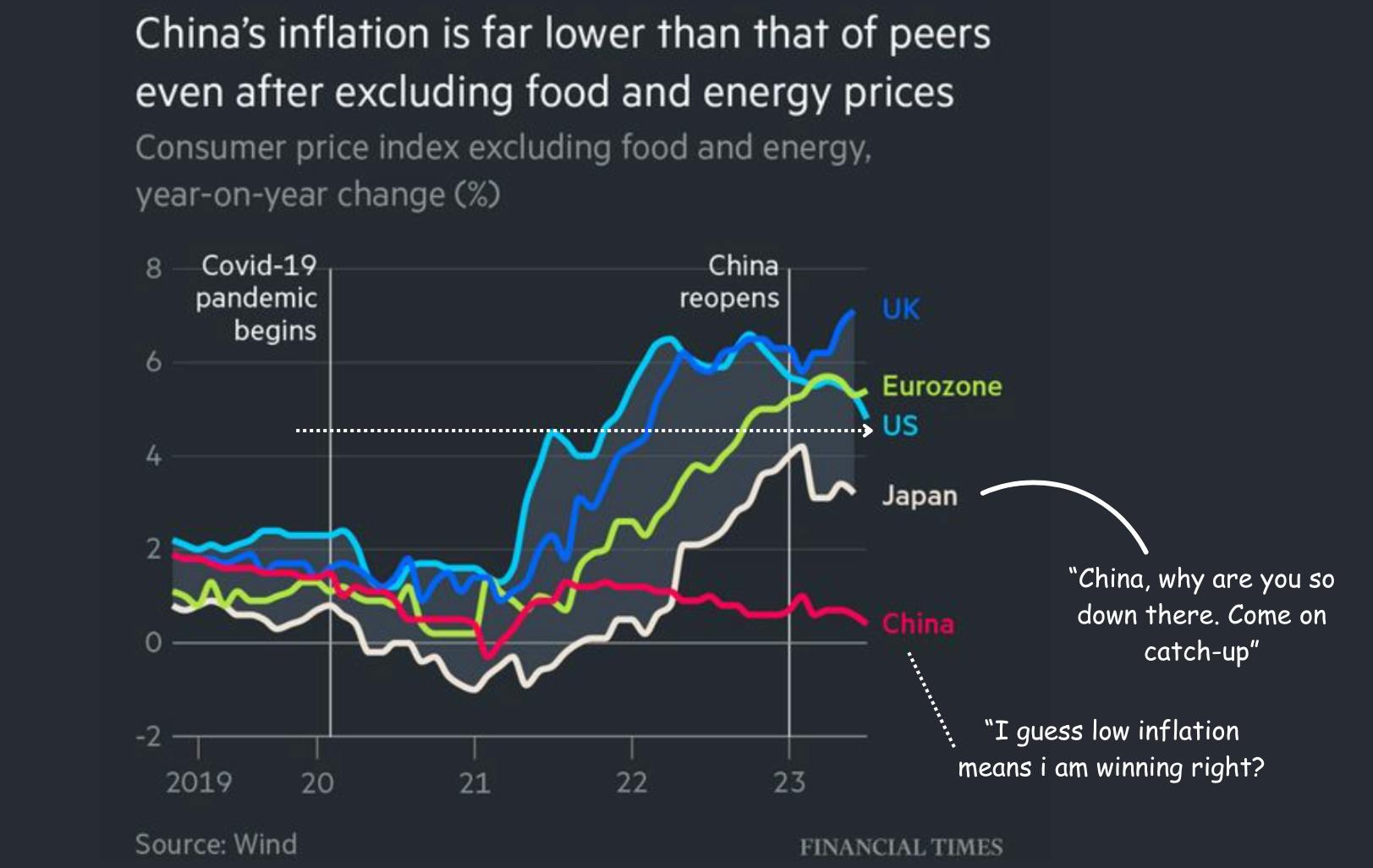

So, continuing where we left, thanks to the covid lockdown, China had significantly decreased its industrial activities. The consumption in China was also down drastically during the housing crisis and pandemic. This is also visible in the inflation numbers, which had cooled down post January 2020, because of low economic activity. The world's factory was facing a heatstroke, but the question is, what were its effect on other countries and more importantly, how did it affect India?

(The fall in 2020 represents the start of crisis and slowdown in Chinese economy)

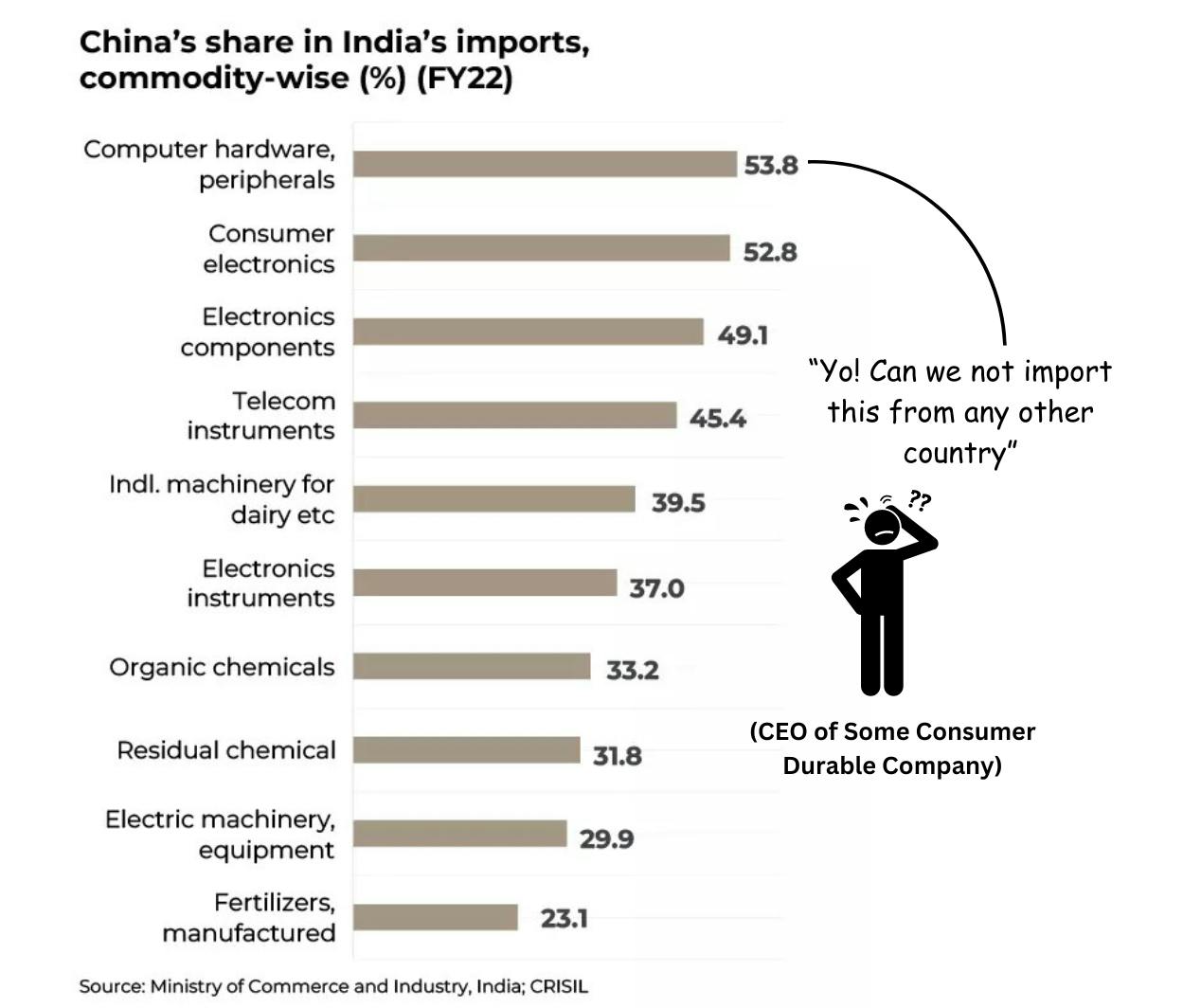

In the beginning, the pressure of Chinese lockdown was felt on commodities throughout the globe. As the mining and industrial activity in China were at record low, prices of chemicals, lithium, steel etc. all shot up. Alongside, prices of capital goods such as manufacturing parts, computer equipment, telecommunication equipment and semiconductor all soared, as China was one of the biggest exporters of these products.

For common man like us, it means prices of finished goods were bound to increase. In some cases, the increase in price was absorbed by companies and consumer both, but in many cases Indian consumers had to face most of the brunt of higher raw material prices. India is a key importer of electrical, computer and telecom equipment from China. In commodities, India imports majority of chemicals, polymers and fertilizers from China. So naturally, a supply side shock in these goods would hugely impact the prices of final good.

This supply constraint phenomenon was observed in India in 2021 and 2022. Due to these factors, consumer durables in India such as AC, TV, Fridge, witnessed high inflation. White Goods such as these, source roughly 35-40% of their components from China, while ACs get roughly 75% of the material from the eastern neighbor. The price increase even though was visible to the consumers, the impact on gross margins of various consumer durable companies were even more severe.

While Indian Consumer Durable companies were suffering with increased cost of raw materials, Indian steel, Chemical and other commodity companies were having the time of their life.

What Happened to Steel Sector in India?

China is the largest producer of steel with roughly 54% of world steel production. The next biggest producer is India with 7.5% of global production. China consumes roughly 90% of the entire steel it produces and exports rest 10%, which is still 5.4% of annual steel supply.

Due to lower steel production in 2020 - 2022, China's export saw a marginal dip. But the timing of export dip coincided with the post-covid recovery of the western world. Which means the steel demand increased in Europe and US, while the exports and production decreased from China's side. And so, our home teams from Indian steel sector tried to fill the gap.

This resulted in a huge jump in steel prices in India as Indian steel players were exporting steel for higher prices to western regions. This prompted government to bring in export tariff for steel exports, so these companies would first cater the national demand, and then someone else's.

What Happened to Chemical Sector in India?

A similar trend was seen in the chemical sector as well, but understanding the chemical sector and that too of China is slightly more tedious. China's chemical export dipped in 2020-2022, because of supply chain constraint. The throughput of top ports saw a decline, the production was halted due to lockdown and China also imposed various pollution norms on chemical industries, all of these reasons decreased the total output of chemical production.

Indian chemical companies, who were already on a bull run with increasing capacity, saw a huge gap and jumped to grab the opportunity. The prices of things such as petrochemicals, alkyl-based chemicals, battery-based chemicals and other specialty chemical's prices shot up. The margins improved slightly, but given the increase in volume, Indian companies saw a good jump in profitability.

But the party has to stop somewhere, and so it did. China started opening up in early 2023, the industrial activities were coming to pre-covid level and shops were opening their shutters. But there was one small problem. The CPI inflation in China was nowhere near other countries, infact, while the rest of the world was battling high inflation, China's CPI was heading downwards (see above chart), indicating a deflation in the economy. The events that followed next, is what we are experiencing today. Stay tuned for next article to read about the deflationary cycle of China.

Ladderup Wealth since 2011 has broken the ranks and established itself as one of the most premier wealth management firms in the country. Your wealth is irreplaceable and you have acquired it after decades of hard work. It is important that it is constantly monitored and nurtured with the right approach. You might not have the right time/skills to do it yourselves, but we can help you on that journey. Improper and incompetent advice can have long term side effects on your wealth, so please choose wisely. Get in touch with us via our website today.